Recommended Facts For Choosing RSI Divergence Trading

Wiki Article

Free Advice For Choosing An RSI Divergence Strategy

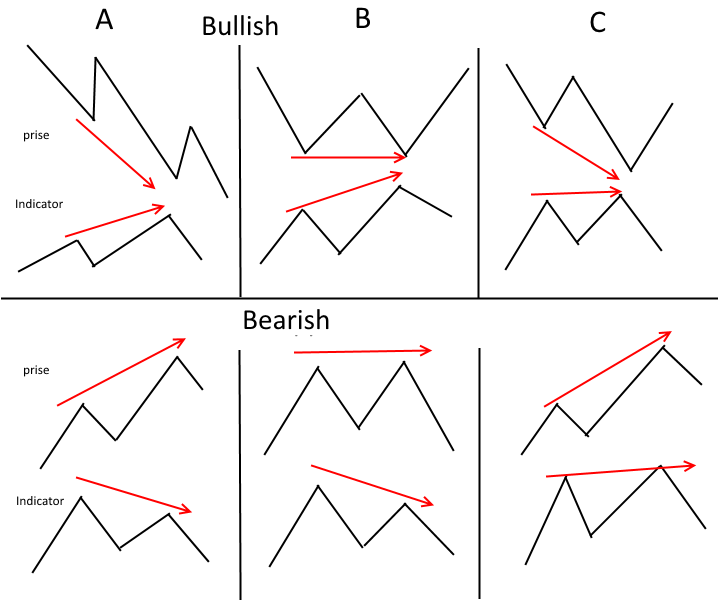

Let's start with the most obvious question. We will explore the definition of RSI Divergence actually is and the trading information we can derive from it. A Divergence occurs in your chart when price action and RSI indicator are out of the alignment. In this case, in an uptrend market, the price action will create lower lows while the RSI indicators will have higher lows. In other words, divergence may be observed when the indicator does not match the price movement. If this occurs, you should be aware. The bullish RSI and the bearish RSI divergence can be easily evident in the chart. The price action was actually reversed by both RSI Divergence signals. Let's discuss one final topic before moving to the topic that is exciting. Take a look at top rated trading with divergence for site info including backtesting platform, backtesting strategies, best crypto trading platform, cryptocurrency trading, trading platform cryptocurrency, backtesting platform, backtesting trading strategies, divergence trading forex, forex backtest software, trading platform and more.

How Do You Assess The Rsi Divergence?

We use the RSI indicator to detect trends that have reversals. To be able to do this, it is essential to have a market trending. Then, we utilize RSI diversgence to determine weak points within the current market trend. In the end, we are able to use that information for the best time to identify the trend reverse.

How To Recognize Rsi The Presence Of A Divergence In Forex Trading

Both Price Action and RSI indicators both formed higher highs prior to the beginning of the uptrend. This usually indicates that the trend seems solid. In the final phase of the trend, prices reach higher highs while the RSI indicator creates lower highs. This means that there are things to be watching within this chart. In this case, we must pay particular attention to the market, since both the indicator's actions and price are outof sync. This implies that there's an RSI divigilance. In this instance, the RSI divergence indicates the bearish trend. Look at this chart to see what transpired after the RSI divergence. It is evident that the RSI divigence is extremely reliable in detecting trend reversals. But the question is, what is the best way to detect the trend reversal, right? Let's look at four strategies for trade entry that can be used in conjunction with RSI Divergence to offer better entry signals. Read the top RSI divergence for blog info including divergence trading forex, position sizing calculator, divergence trading forex, cryptocurrency trading, automated trading bot, backtesting platform, trading platform crypto, forex backtesting, trading divergences, forex backtesting and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Two different versions of the triangle chart pattern are accessible. The pattern of the ascending triangle can be used to reverse a downtrend. The second is the descending triangular pattern, which is employed in markets that are in an uptrend to act as a reversal. Below is the downward triangle pattern. Like the earlier instance, the market was in an upward trend , but the price started to fall. RSI can also be a signal of divergence. These clues show the weakness in this uptrend. Now we see that the speed of the current upward trend has diminished and the price has ended with a downward triangular pattern. This indicates that there is an inverse. Now it's time to execute the trade. The trade was completed using the same breakout methods similar to the one used in the previous trade. We will now look at the third trade entry technique. We'll be pairing the structure of the trend with RSI diversion. Learn to trade RSI Divergence when trend structure changes. Take a look at recommended forex tester for site recommendations including trading platform cryptocurrency, best forex trading platform, best crypto trading platform, best trading platform, trading platform crypto, position sizing calculator, forex backtesting, cryptocurrency trading bot, crypto trading backtester, crypto trading backtester and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI diversification can be a valuable tool for forex traders to recognize market reverses. What if we combine RSI divergence together with other factors that can cause reversals, such as the Head and shoulders pattern? We can boost the chance of making a trades. That's great to be sure, isn't it? Let's look at how to time trades with RSI divergence in conjunction with the head-shoulders pattern. Related to: How to trade the Head and Shoulders Pattern in Forex. A Reversal Trading Strategy. A stable market is necessary before we consider trading. Trending markets are better because we're looking for the possibility of a trend reversal. Check out the chart below. Check out the best automated forex trading for site examples including automated forex trading, backtesting trading strategies, trading with divergence, forex backtesting software free, forex trading, forex tester, trading platform, position sizing calculator, crypto backtesting, best trading platform and more.

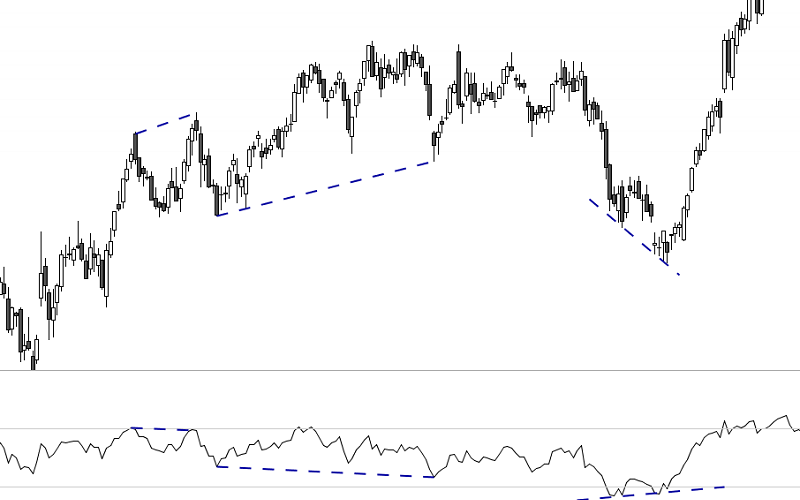

Tip #3 – Combining RSI Divergence With the Trend Structure

The trend is our partner. If the market is in a trend, then we should invest in the direction of that trend. This is what professionals tell us. The trend will end eventually however it will not last for ever. Let's now see how to detect reversals using the structure of the trend and RSI divergence. As we all know, the upward trend is creating higher highs while the downward trend forms lower lows. In this regard, let's take a closer glance at the chart below. On the left hand part of the chart, you'll observe a downward trend. There are many of lows, and then lower highs. Next, you can see the RSI deviation (Red Line). The RSI creates high lows. Price action causes lows. What is this implying? Even though the market has created low RSI it is actually doing the opposite. This suggests that an ongoing downtrend might be losing momentum. Check out the best trading with divergence for more examples including automated cryptocurrency trading, forex trading, divergence trading forex, automated trading software, automated crypto trading, forex backtest software, trading divergences, forex backtesting, trading platform, backtesting trading strategies and more.

Tip #4 – Combining Rsi Divergence, The Double Top Double Bottom Double Bottom

Double-bottom or double-top is a reversal chart which develops after a lengthy move or the emergence of a trend. The double top is formed when a price threshold can't be broken. The price will then rebound slightly, but then return to the prior level. Double tops occur when the price bounces from the threshold. Check out the double top that is below. In the double top above, you will see the formation of two tops following a powerful move. The second top wan not able to break above the first top. This is a sure sign that a reversal is going occur because it's warning that buyers that they are struggling to go higher. Double bottoms also employ the same principles but is executed in a different direction. We will apply the breakout entry method. We make selling whenever the price is below the trigger level. We took our profit once the price was below the trigger line. Quick Profit. The same strategies for trading are used for double bottom, too. The following chart shows how to trade RSI Divergence with Double Bottom.

Be aware that this isn't the only trading strategy. There isn't a single trading strategy that is ideal. Also each trading strategy has losses. We make consistent profits through this strategy, however we are using tight risk management and a method to cut our losses quickly. This way, we are able to reduce our drawdown and also can open the way to huge upside potential.